Payment of freelancers internationally

You would like to work with a freelancer domiciled/registered in another country, this is possible under certain conditions.

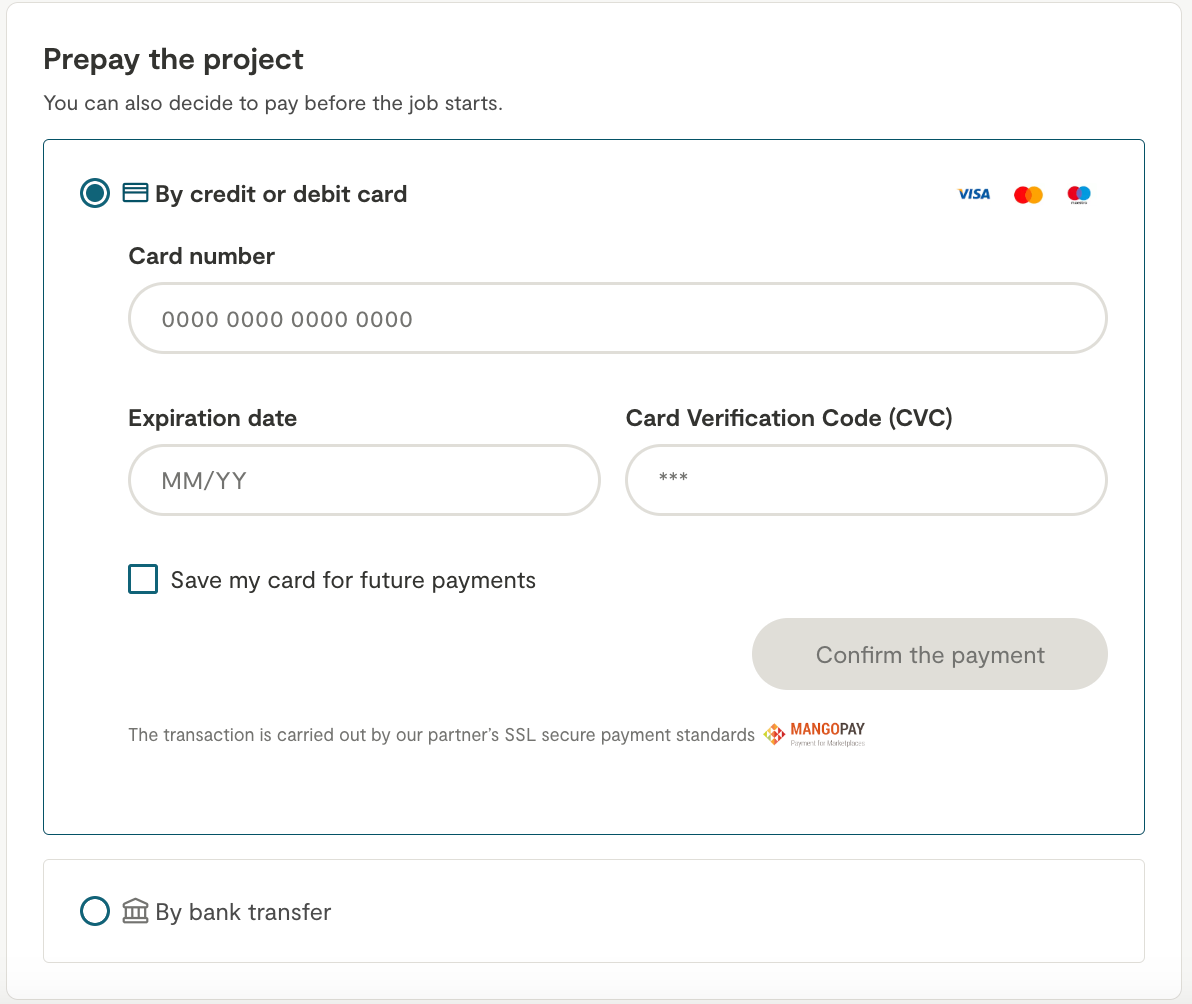

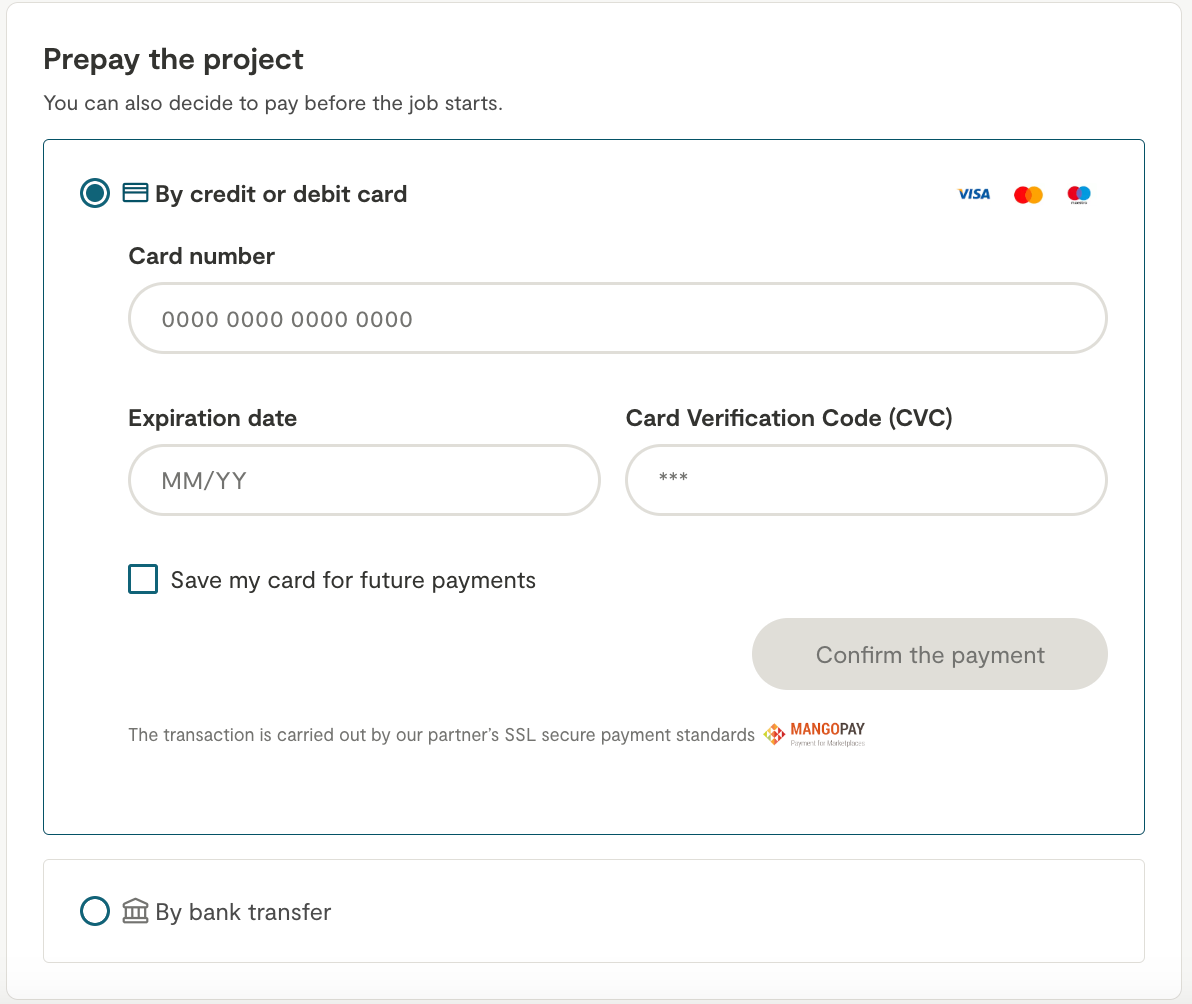

In order to comply with the rules to combat fraud and money laundering, our payment provider MANGOPAY authorizes payments by bank card or transfer to and from certain countries.

On the other hand, the use of online banks is possible from abroad (Payoneer, Quonto, etc.)

VAT management

VAT management with a freelancer based abroad:

When a freelancer sends you their quote, you may be subject to several rules regarding the taxes to which you are subject.

Several cases are possible:

The freelancer is registered in the same country as you : You will have to pay all the taxes that apply to its legal form, VAT.

The freelancer is not registered in the same country as you , but is part of the European Union:

If you both have an intra-community VAT number, then you benefit from self-liquidation of VAT and therefore you will not be subject to payment of VAT on the invoice for the service.

If the freelancer does not have an intra-community VAT number, then you will be subject to payment of the VAT corresponding to the legal form of the freelancer.

The freelancer is not in the same country as you , and is not part of the European Union: no tax is applied to the quote, the VAT will be 0%.