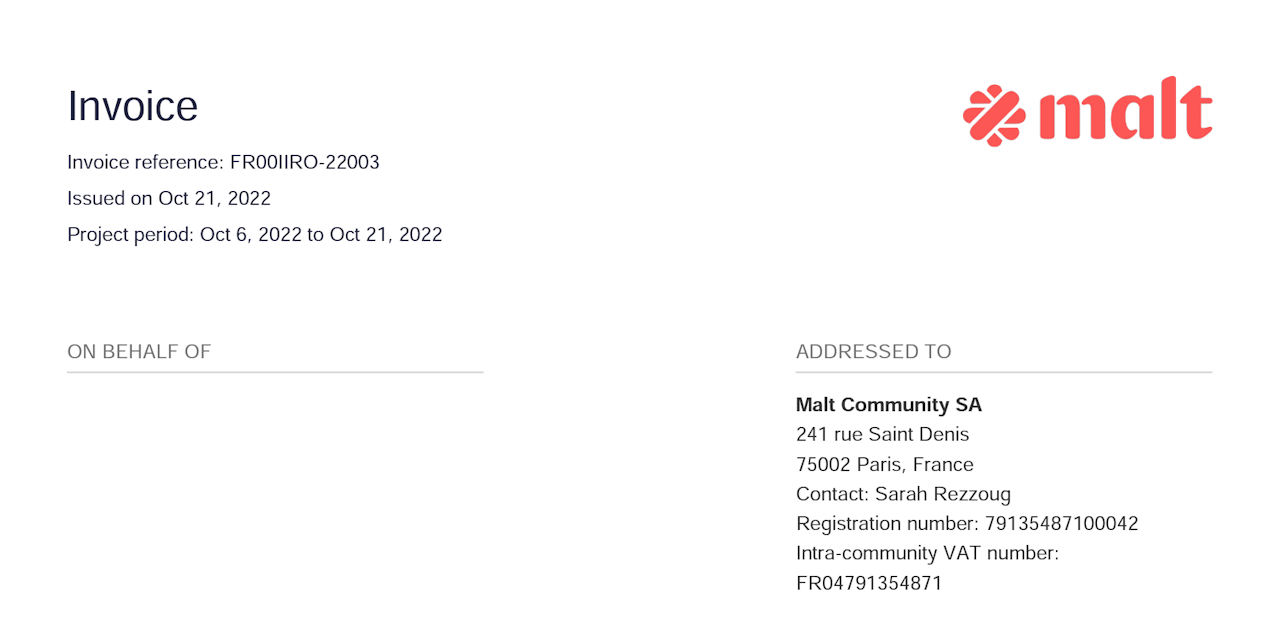

Malt has an invoicing mandate, which means Malt can create invoices:

in the name and on behalf of the freelancer with whom you work;

in the name and for your account (client)

At the end of your project, the financial documents (quotes and invoices) are established and issued automatically by Malt in the name of your company. This is why it is important to enter the correct information in your account settings.

These documents have a standardised Malt header and therefore include the freelancer's billing details as well as those of your company.

This Mandate is established in accordance with the regulations in force and in particular the provisions of article 1984 of the civil code and articles 242 nonies AI and 289 I-2 of the general tax code.

The different billing models

Malt offers 2 main models of invoicing contracts:

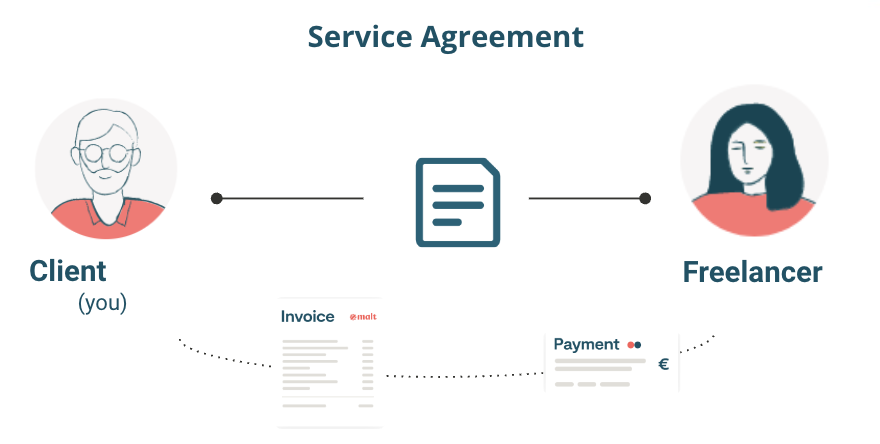

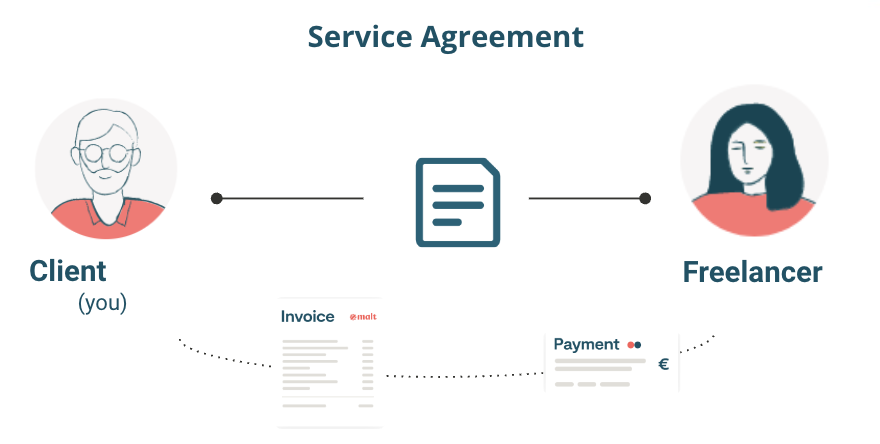

The direct model

This model allows direct contracting with the selected candidate.

The contract as well as invoicing is made directly between you and the freelancer.

The advantages of this billing model are:

Strong legal security in terms of labor law.

A project carried out by Hiscox's Professional Civil Liability of the freelancer.

The freelancer is committed to the success of the project.

This model can be used for task-based or fixed-price projects.

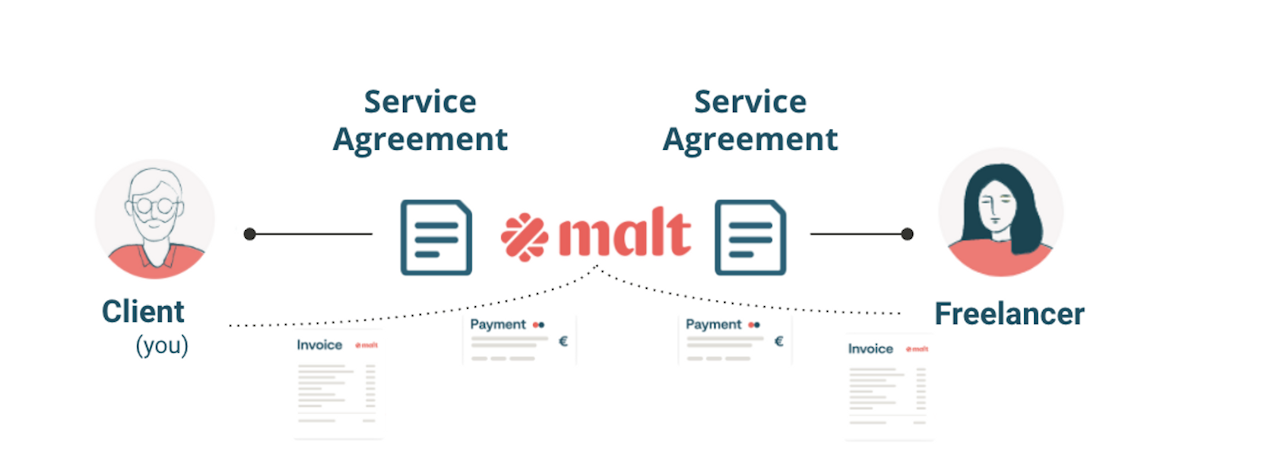

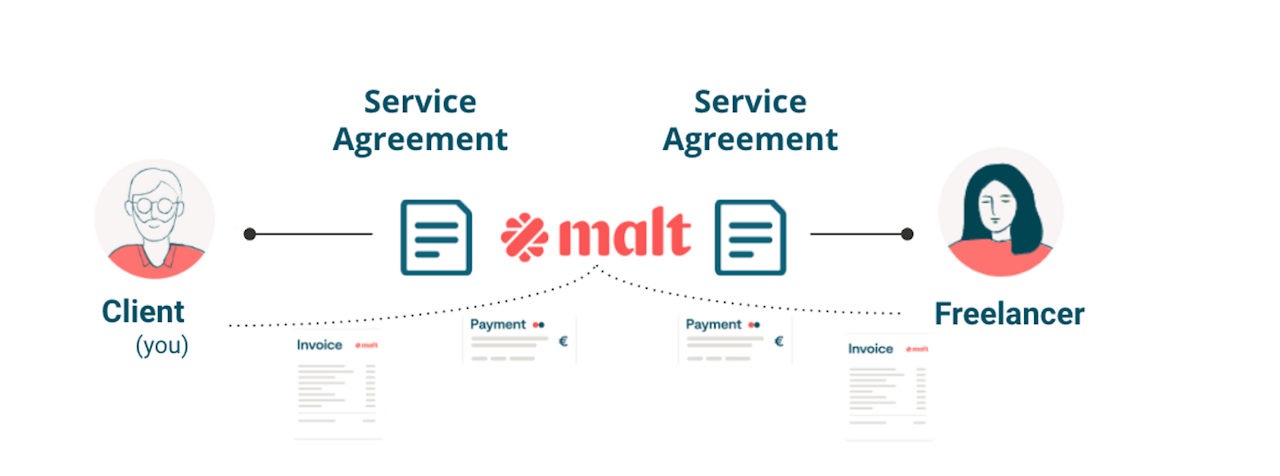

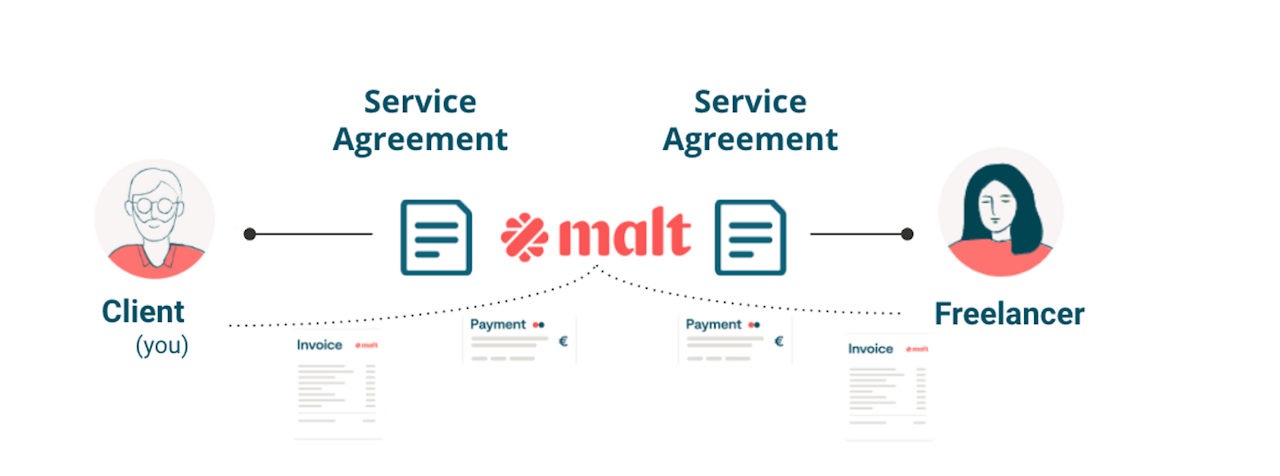

The Unique Provider model

This model allows the issuance of a single invoice with Malt in which the project amount and Malt's service charges are included:

Malt signs a framework agreement with the client, then subcontracts the services to the freelancer in a mirror contract.

There is no contract between the client and the freelancer, unlike the direct model.

This model is only available to clients with the Advanced Plan or above and is only applicable in France, Belgium, Spain, the Netherlands and Germany.

How the Unique Provider model works

1) You choose the freelancer you want to work with, then freely negotiate the terms and conditions of the service.

2) A framework agreement is concluded between you and Malt, which will detail the conditions of execution of the project.

3) Malt signs a back-to-back agreement with the selected freelancer, which consists of a mirror version of the framework agreement between Malt and you.

4) This means that all contractual provisions between Malt and you will be passed between Malt and the freelancer.

5) Malt obtains the freelancer's commitment to the obligations subscribed to you.

The advantages of this billing model are:

Strong legal security in terms of commercial law.

The transfer is ensured by Hiscox's Malt Professional Civil Liability.

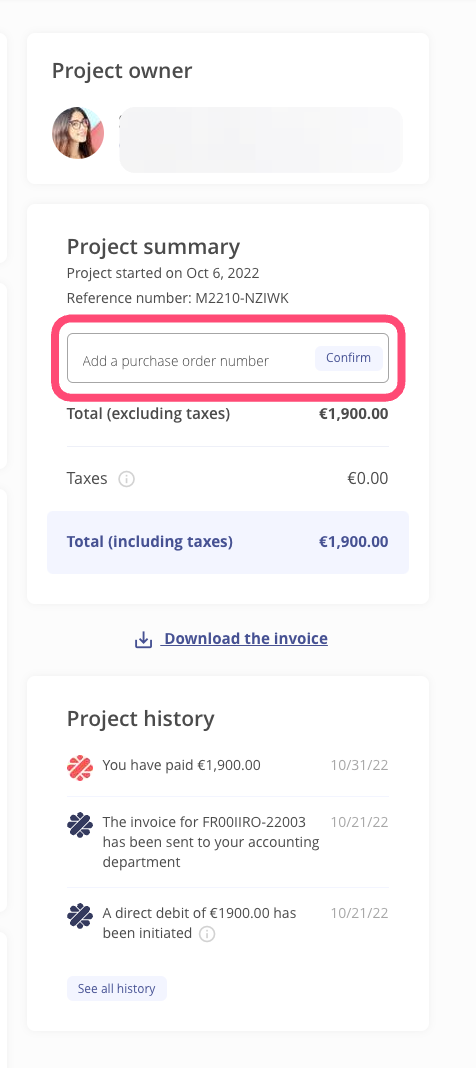

Generate a purchase order for the service

Before starting a service, contact the appropriate department to initiate the procedure for issuing the order form.

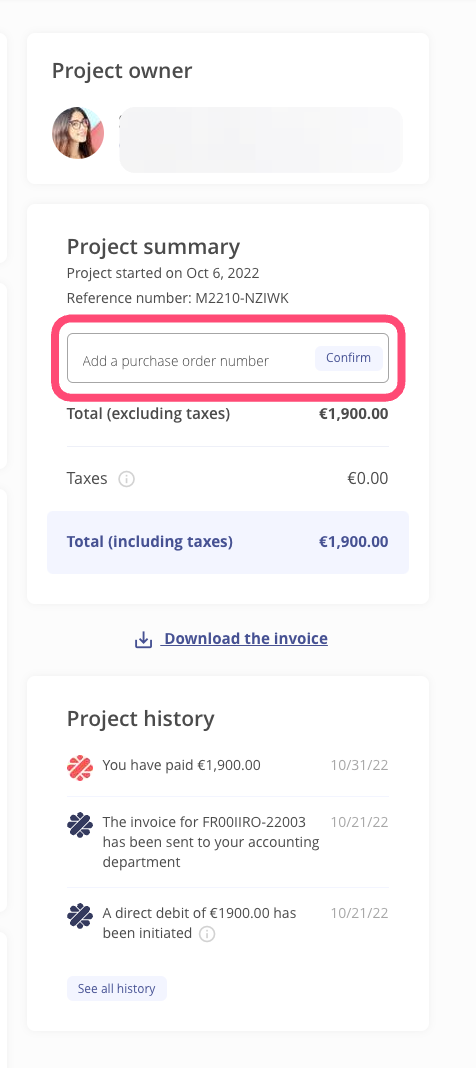

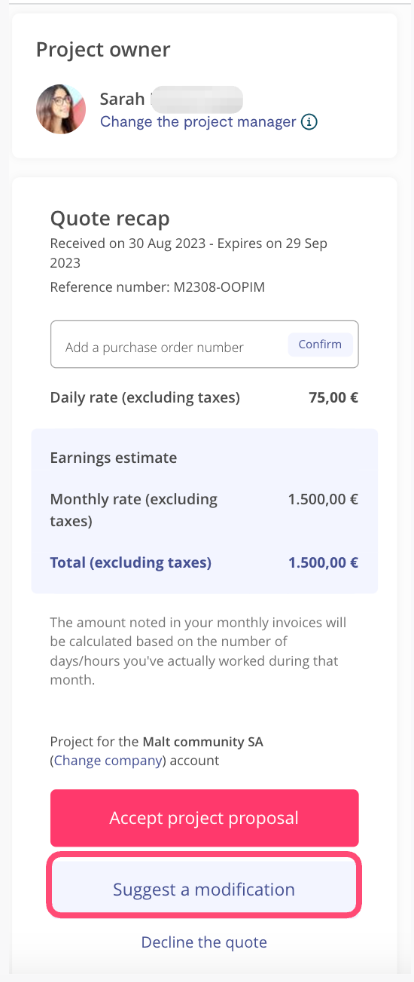

Upon receipt of this, we invite you to add it directly to the quote by going to the service page.

This will allow a very simple reconciliation by your accounting department (thanks to the internal purchase order and the freelancer's invoice number at the end of the service).

Issuing and downloading invoices

The final invoice is generated when the freelancer submits the end of the project in the case of a task-based project, and at the end of each month for time-based projects.

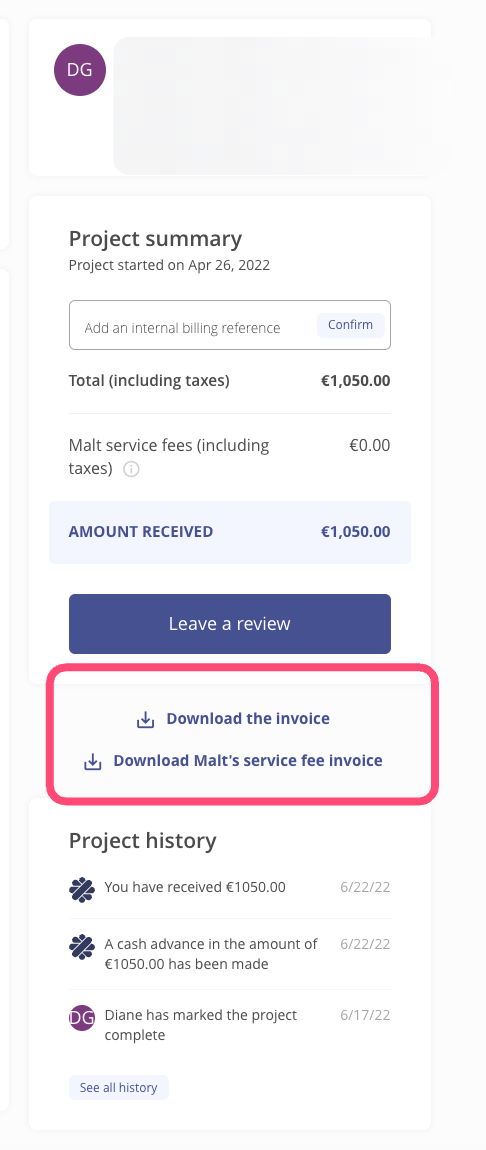

Three invoices are issued:

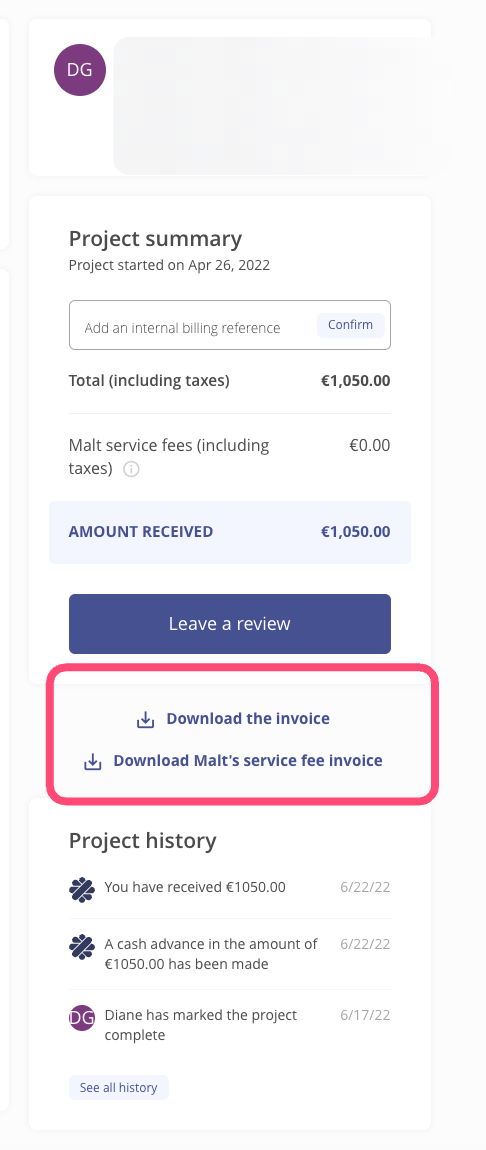

The first concerns the service (invoice between the freelancer and you).

The second concerns the service fees for the customer (invoice between Malt and you).

The third for the freelancer concerns the Malt commission (invoice between Malt and the freelancer).

For time-based projects, the invoice statement will be sent to the accounting email address provided in your settings upon validation of the project or month.

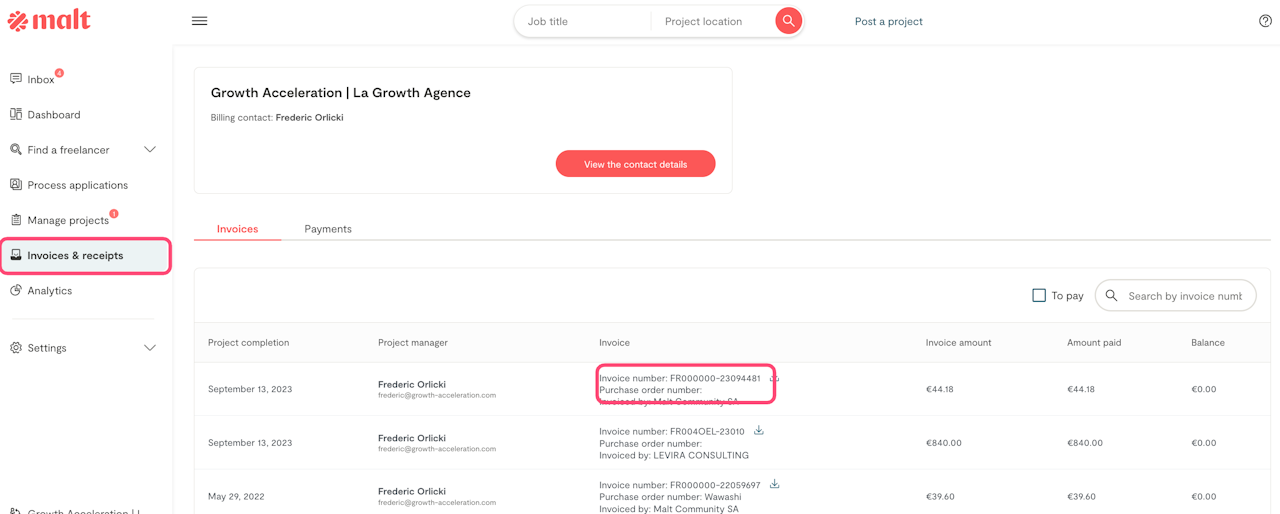

To find and download all of your invoices, you have two options:

Go to the project page and click on “download the invoice statement”

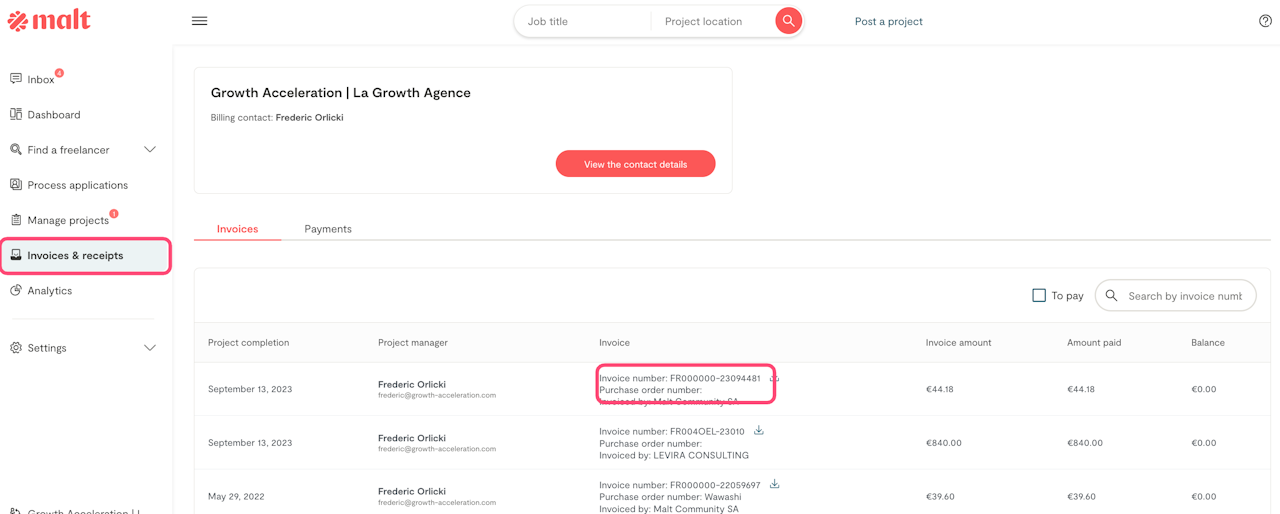

You can also find the history of all your invoices in the "invoices and payment" section of your personal space.

Editing your project

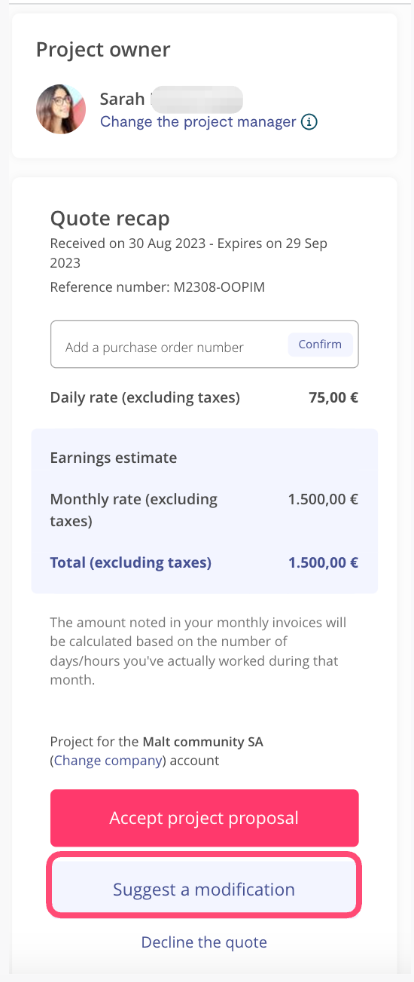

In the event that your project evolves, and you and the freelancer agree to modify the estimate, the invoice issued at the end of the project will correspond to the new estimate.

Task-based project

For a task-based project, here is the process to follow to modify a quote:

The freelancer modifies the quote on the project page,

You validate the modification of the quote.

In case of pre-payment:

Quote modified downwards, you will be reimbursed for the delta at the end of the mission on your wallet within 2 working days,

Quote modified upwards, you will have to complete the payment of the difference provided for in the new quote. You can pay directly from the mission URL by credit card or bank transfer.

Time-based project

To modify the project in agreement with the freelancer, please contact the support team: support@malt.com

VAT payment

VAT on the commission invoice

Our billing entities - Malt has 6 entities in Europe:

Malt SA = France and rest of the world

Malt SL = Spain

Malt BV = Netherlands

Malt SRL = Belgium

Malt Gmbh = Germany (from September 2023)

Malt Limited = UK (from September 2023)

The existence of these different entities has a direct impact on:

VAT applied to commission invoices in the DIRECT and sole supplier (UP) model

VAT applied to freelance service invoices under the single supplier (UP) model

For each project, the freelance commission invoice as well as your service fee invoice are issued by the entity you report to.

When will VAT be applied to the commission invoice?

As a reminder, customer entity = entity issuing the commission invoice.

If the Malt entity issuing the invoice is based in the same country as you then VAT will apply to the commission invoice.

If the Malt entity issuing the commission invoice is based in a different country to where you are based then VAT will not apply to the invoice in accordance with the self-liquidation principle*

The same principle will apply to service invoices for the single supplier (UP) model because the entity that will appear on the invoice will be the one on which your customer depends.

Self-liquidation : As a freelancer who has contracted with a client based in a country other than yours, your invoice will be tax-free and the client will have to declare this intra-community delivery and remit the VAT to the tax administration on which it depends.

Self-liquidation was implemented within the European Union to facilitate exchanges and trading between its different member states.